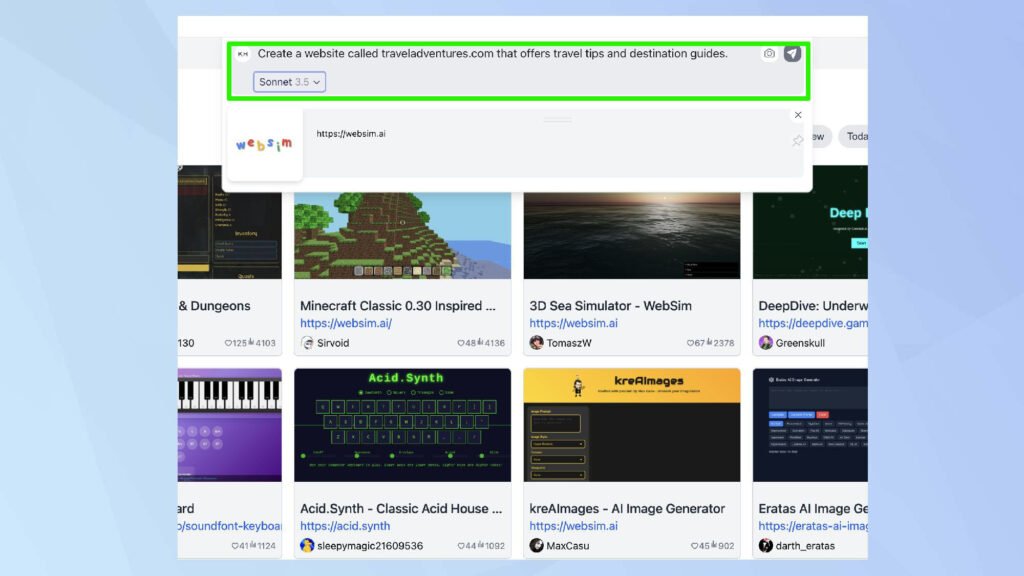

When it comes to paper trading and simulating investment strategies, Websim is a tool that many budding and experienced traders have relied upon. It offers the ability to backtest strategies using historical data without risking real capital. However, like any platform, Websim has its limitations—whether it be interface constraints, lack of support for certain asset classes, or limited integration with other financial tools. As a result, many users seek Websim alternatives that nanonexts alternatives can provide more functionality, better user experience, or specific features tailored to their trading needs. In this article, we explore some of the most reliable and effective alternatives to Websim for simulating and testing financial strategies.

1. TradingView: Visual and Comprehensive Charting with Strategy Testing

TradingView is one of the most popular platforms for charting, strategy development, and backtesting. It offers an intuitive user interface, powerful scripting capabilities via Pine Script, and access to an extensive library of indicators and strategies. Users can test their trading algorithms on historical data across multiple asset classes including stocks, forex, and cryptocurrencies. TradingView also provides social features like sharing ideas, which makes it a hub for both novice and professional traders. Unlike Websim, which primarily focuses on code-based simulations, TradingView allows a more visual and interactive experience, making it easier for users to interpret the performance of their strategies. Its freemium model ensures basic features are accessible to everyone, with premium options unlocking additional data and backtesting capabilities.

2. QuantConnect: Advanced Backtesting for Quantitative Traders

QuantConnect is another strong alternative, particularly suitable for users with programming skills in C# or Python. Built on the Lean Algorithm Framework, QuantConnect offers powerful backtesting tools that allow users to simulate trading strategies with institutional-grade data. This platform is ideal for quants, data scientists, or algorithmic traders looking to test highly customizable strategies. Unlike Websim, which can feel limited in its analytical depth, QuantConnect allows integration with cloud computing and supports equities, forex, futures, and crypto markets. Furthermore, its support for machine learning models and research environment gives users a major edge when exploring complex financial algorithms.

3. MetaTrader 4/5: A Robust Platform for Forex and CFD Strategy Testing

For those focused on forex and CFD markets, MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are solid choices. These platforms offer built-in strategy testers and allow backtesting using Expert Advisors (EAs), which are automated scripts written in MQL4 or MQL5. While MetaTrader is less beginner-friendly compared to graphical platforms like TradingView, it provides a more flexible and detailed environment for testing and optimizing trading bots. One advantage over Websim is the real-time execution simulation, which allows users to understand how their strategies perform under various market conditions. Moreover, MT5 supports multi-threaded testing and cloud computation, making it efficient for running numerous scenarios quickly.

4. Backtrader: Open-Source Python Library for Custom Simulations

Backtrader is a powerful open-source framework designed for Python developers interested in testing trading strategies. It provides comprehensive tools to conduct backtests, perform strategy optimization, and visualize results in various formats. Unlike Websim, which may have limited language support and customization, Backtrader enables total control over every aspect of strategy design and execution. Users can import external data, test strategies on different timeframes, and even integrate with live brokers like Interactive Brokers for real-time trading. Its open-source nature means it’s continuously improved by a community of developers, and it’s an excellent option for users who want complete transparency and control.

5. NinjaTrader: Professional Grade for Active Traders

NinjaTrader is a premium trading platform geared toward professional and active traders. It offers both simulated and live trading environments and supports detailed analytics, custom scripting through NinjaScript (based on C#), and integration with major brokerage services. While it’s more complex than Websim, it compensates with a broad range of features including tick-by-tick data simulation, advanced charting, and trade execution systems. It is especially favored by futures and options traders. Although it has a steeper learning curve, the depth of customization and professional-grade tools make it a worthy upgrade for users looking to evolve beyond Websim’s capabilities.

Conclusion

While Websim serves as a good entry-level tool for strategy simulation, its functionality is quite limited when compared to modern and more comprehensive platforms. Tools like TradingView and QuantConnect offer broader market access and better visualization, while platforms such as MetaTrader, Backtrader, and NinjaTrader provide professional-grade features for serious traders and developers. Choosing the right alternative depends largely on your experience level, technical skillset, and the markets you intend to trade in. By understanding the strengths and weaknesses of each option, you can select a platform that not only meets your current needs but also supports your growth as a trader or financial strategist.